2023 Schedule B Form - Printable Forms Free Online

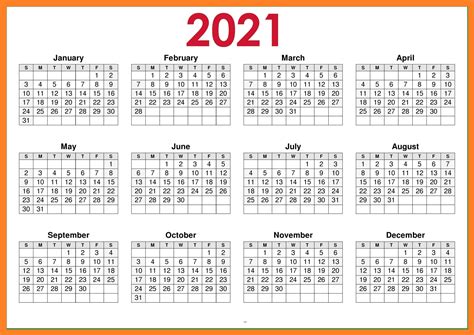

About 2021 Printable

Download and print the official form for reporting interest and ordinary dividends on your 2021 tax return. Fill out Part I and II for domestic accounts, and Part III for foreign accounts or trusts if applicable.

Printable Federal Income Tax Schedule B. You should use Schedule B if any of the following apply-You earned over 1,500 of taxable income.-You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

Where do you get the information to file Schedule B? The information needed to fill out Schedule B can generally be found in 2 other tax forms 1099-INT and 1099-DIV. Form 1099-INT This shows interest income you received during the year. You should get one from any person or entity usually a bank or brokerage firm that paid you at least 10 in interest in the previous tax year.

Line 6. Add the total from the Amount column in Line 5.Enter the result here and on Line 3b of your Form 1040 or 1040-SR. If the Line 6 amount exceeds 1,500, you must complete Part III, below.. Part III Foreign accounts and trusts

Step-by-step instructions on how to fill Schedule B of Form 1040 to report Interest and Ordinary Dividends received during the tax year 2021. Moreover, every taxpayer who receives more than 1,500 in taxable interest or dividends has to file Schedule B Form 1040. Schedule B helps to fill relevant amounts into Form 1040.

Download and print the PDF form for reporting interest and ordinary dividends on your federal tax return. Learn how to complete Parts I, II, and III of Schedule B and when to file FinCEN Form 114 or Form 3520.

Page 1 of 3 1855 - 22-Jul-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Internal Revenue Service 2021 Instructions for Schedule BInterest and Ordinary Dividends Use Schedule B Form 1040 if any of the following applies.

Use Schedule B Form 1040 if any of the following applies You had over 1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

In summary, the Form 1040 Schedule B is used to report interest and ordinary dividend income, providing a detailed breakdown of these types of income. Accurate completion of this schedule is essential for taxpayers who receive significant interest and dividend income, as it ensures accurate reporting and claim of deductions and credits.

Filing Schedule B involves more than just reporting numbers you must carefully check each entry for accuracy. Include all taxable interest exceeding 1,500, as well as any required information regarding foreign accounts. Once completed, attach Schedule B to your Form 1040 or 1040-SR and submit your return to the IRS.